Door number 2!🎁

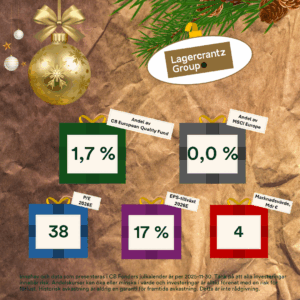

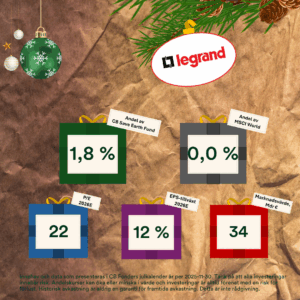

Behind the second door we find Lagercrantz, the second-smallest holding in the CB European Quality Fund, and Legrand, the second-smallest holding in the CB Save Earth Fund.

Lagercrantz – a Swedish serial acquirer specialised in technology companies.

⭐ 80 Profitable niches: Lagercrantz consists of around 80 specialised B2B companies, each focused on profitable niches with clear leadership potential.

⭐ Long-term: The subsidiaries operate with a high degree of autonomy, retaining their entrepreneurial spirit while receiving support and structure from the group to enable long-term, stable growth.

⭐ Value creation: The group’s decentralised model and its ability to identify and develop high-quality companies have become key drivers of Lagercrantz’s long-term value creation.

🌱 Lagercrantz meets the Article 9 requirements of the European equity fund, partly by setting internal CO₂ reduction targets aligned with the Paris Agreement.

Legrand – a French global leader in electrical and digital building infrastructure.

⭐ Market leader: The company is often the market leader in its niches, and its broad product range, global reach, and strong brand allow it to maintain price premiums and stable profitability.

⭐ Demand across economic cycles: Legrand benefits from long-term trends such as electrification, energy efficiency, and the digitalisation of buildings, which drive steady demand across economic cycles.

⭐ Broad offering: Its offering spans everything from residential wall outlets to complete data-centre and IT infrastructure systems, giving the company broad exposure to both the construction and IT sectors.

🌱 Legrand meets the Article 9 requirements of the environmental fund, partly through its work with the UN Sustainable Development Goals and its SBTi-verified CO₂ reduction targets.

Please be aware that the CB Funds Christmas calendar presents the fund’s holdings as of 2025-11-30. Please note that all investments involve risk. Unit prices may increase or decrease in value, and investments always carry a risk of loss. Past performance is never a guarantee of future results. This is not investment advice.