The world’s best environmental companies.

CB Save Earth Fund invests in high-quality growth companies that address global environmental issues through innovation and new technology. These companies are leading the way in greener energy, addressing urgent water issues such as clean water, and working towards long-term environmental improvements.

The technological advancements we see in the environmental sector can be compared to technological shifts in other industries, shifts that have often occurred faster than anyone could have anticipated.

We are a global environmental fund that invests in three megatrends with strong tailwinds: cleantech, water management, and renewable energy. A common denominator is efficiency, where we invest in companies active in energy and water efficiency.

Today, we are one of the leading environmental funds in the Nordic region in terms of our long history and number of fund owners through Avanza and Nordnet. We are convinced that companies that solve global environmental problems through new technology have a significant competitive advantage.

CB Save Earth Fund was one of the world’s first environmental funds to receive the Nordic Swan Ecolabel, thanks to extensive sustainability efforts.

Strategy and Investment Objectives

CB Save Earth Fund is an actively managed global environmental fund that invests in profitable companies benefiting from structural growth and megatrends in renewable energy, water, and cleantech. The water sector and cleantech are the fund’s primary investment areas and core holdings, with renewable energy serving as a supplement.

CB Save Earth Fund invests in stocks, with geographical exposure primarily in Europe and North America.

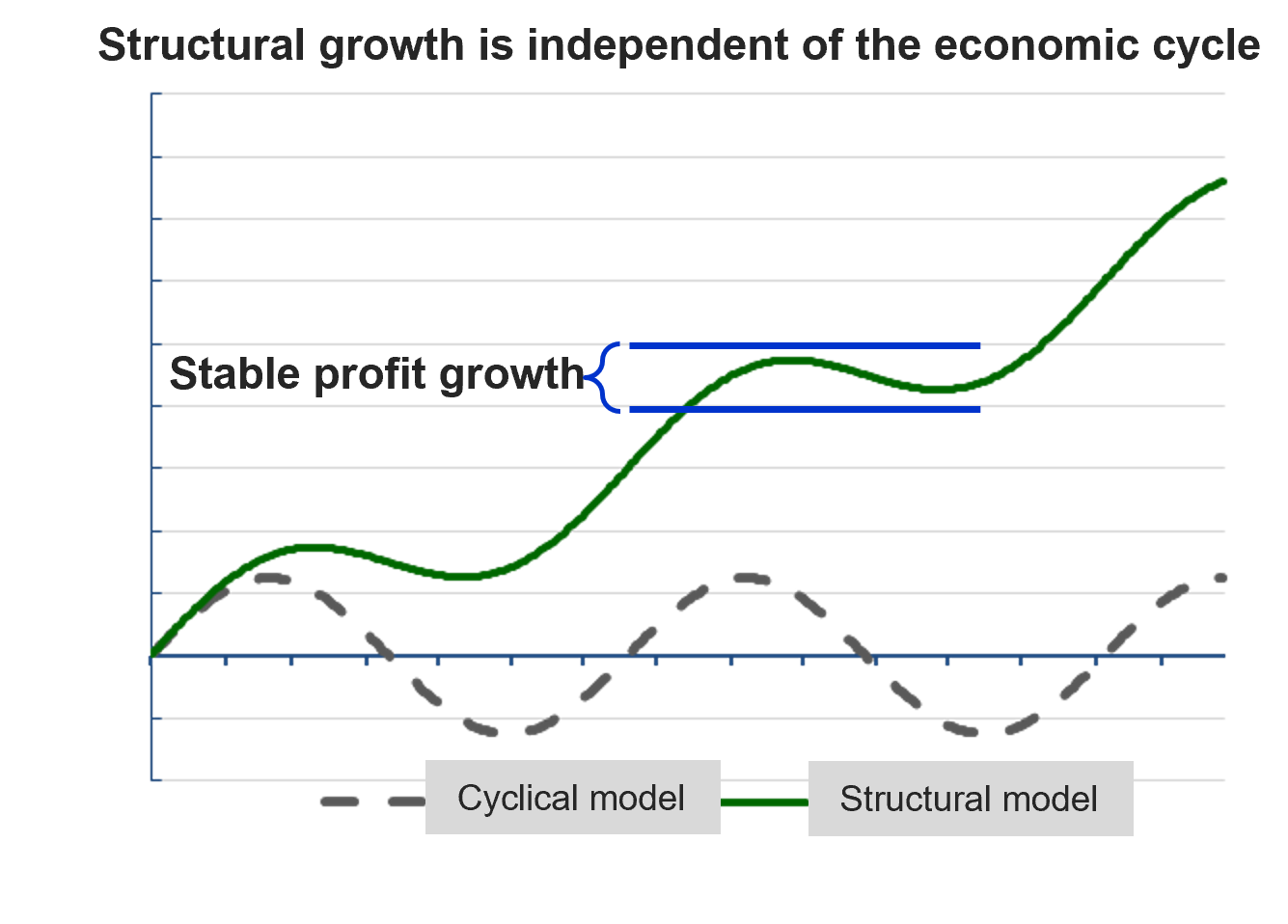

The focus is on growth companies with a proven business model and management that has historically delivered added value. Our companies are market leaders with strong products and solid balance sheets. The companies should have stable and structural profit growth regardless of economic conditions.

Our investment decisions are long-term, considering an ethical and sustainable framework, as well as UN PRI. We prefer to hold companies for an extended period and grow with them.

We are willing to deviate from the index and maintain a concentrated portfolio typically consisting of 30-40 companies in which we have great confidence. Our goal is to outperform our benchmark index, the MSCI World Net index, over a rolling 12-month period with lower risk than the index. This creates good conditions for high and competitive risk-adjusted returns.

Our investment areas

Water Management

Water is the world’s most important natural resource and there are no substitutes. Global issues include water pollution, water scarcity, and a water demand expected to exceed supply by 40 percent by 2030.

We invest in companies involved in purification, distribution, efficiency, wastewater management, and infrastructure.

Cleantech

Manufacturing and consumption have impacts on the environment, and through new technology, it’s possible to reduce the negative effects. Cleantech improves and cleans the environment.

Our portfolio includes companies in energy storage, energy infrastructure, energy efficiency, materials, recycling, and waste management.

Renewable Energy

The energy sector is currently undergoing a paradigm shift where new energy sources are taking over the leading role from finite natural resources.

Examples of investment areas include wind power, solar energy, hydropower, bioenergy, and geothermal energy.

Our investment areas

Water Management

Water is the world’s most important natural resource and there are no substitutes. Global issues include water pollution, water scarcity, and a water demand expected to exceed supply by 40 percent by 2030.

We invest in companies involved in purification, distribution, efficiency, wastewater management, and infrastructure.

Environmental Technology

Manufacturing and consumption have impacts on the environment, and through new technology, it’s possible to reduce the negative effects. Environmental technology improves and cleans the environment.

Our portfolio includes companies in energy storage, energy infrastructure, energy efficiency, materials, recycling, and waste management.

Renewable Energy

The energy sector is currently undergoing a paradigm shift where new energy sources are taking over the leading role from finite natural resources.

Examples of investment areas include wind power, solar energy, hydropower, bioenergy, and geothermal energy.

Environmental & Ethical Focus

The funds investments are guided by an ethical and sustainable framework. It is important for us to deliver competitive returns within the framework of environmental, social responsibility, and sustainability. We believe that ethics and sustainability are of utmost importance for a company’s ability to create and maintain stable long-term returns.

Our investment strategy targets high-quality growth companies with sustainable business models and stable profit growth. Both of our funds have received the second-highest ESG rating from MSCI as well as the highest respectively second-highest ratings from Morningstar.

We signed the United Nations Principles for Sustainable Investment in February 2011.

CB Save Earth Fund are working towards all of the UN’s 17 Sustainable Development Goals.

We are members of SWESIF, Sweden’s forum for sustainable investments.

How we work

Our passion for the environment and ethical investments permeates every decision we make. We have operated under an ethical framework for over 25 years and have been involved in environmental investments for over 15 years. This has established us as pioneers in environmental and ethical investing. We invest long-term in high-quality growth companies with sustainable business models and stable profit growth.

Active

We are independent, chart our own course, and always make our own active investment decisions that are independent of the index.

Ethical

We invest in quality companies, according to ethical guidelines and frameworks for sustainable investments from UN PRI and SWESIF.

Long-term

We invest long-term in companies with future potential. If the companies we’ve invested in delivers according to plan, then they stay in our portfolio.

“A lot of private investors really want to make a difference with their money”

“There’s a host of new ethical and sustainable investment options”

“A favorite fund when it comes to the environment and sustainability”

“Save Earth Fund has outperformed its competitors”

Let the experts do the work

We are a dedicated team with more than 10 years of experience in jointly managing CB Save Earth Fund and CB European Quality Fund. We are a small management team with short decision-making processes, and all decisions are made collectively.

CB Fonder is a family- and partner-owned securities company with over two decades of experience in ethical investments and over 15 years of experience in environmental investments. The fund managers are partners in the company and invested in the funds – we have full incentives to do a good job and are in the same boat as you as investor.

Carl Bernadotte

Majority Owner & Portfolio Manager

Marcus Grimfors

Partner & Portfolio Manager

Alexander Jansson

CEO, Partner & Portfolio Manager

Fund facts

Fund name

CB Save Earth Fund

Inception

9 June 2008

Fund type

Equity fund

Strategy

Long-only equties within the sectors:

– Renewable energy

– Water management

– Clean technology

Holdings

Normally 30-40 stocks

Investment restrictions

Single positions – max 10% of AUM Sum stock positions > 5% AUM – max 40% of AUM

Target

Outperform MSCI World Net – rolling 12 months. Lower standard deviation than MSCI World Net

Fund company

FundRock Management Company S.A., Luxembourg

Depositary

Skandinaviska Enskilda Banken S.A., Luxembourg

Domicile

Luxembourg

Fund currency

EUR

Trading

Daily

UCITS-classification

Yes

Share classes

RC

RC-SEK

IC

ID*

*Share class ID pays a dividend to its shareholders amounting to 3% of NAV twice a year.

Fees

| Share class | RC/RC-SEK | IC/ID |

| Management fee: | 1% | 0.5% |

| Performance fee: | No | 20% on return > MSCI World |

| Subscription fee: | No | No |

| Redemption fee: | No | No/1% |

| High-water mark: | N/A | Yes, eternal collective and relative |

| Minimum investment amount: | No | 0.5 MEUR |

Fund codes

| ISIN | RC: LU0354788688 |

| RC-SEK: LU1760112463 | |

| IC: LU0354788506 | |

| ID: LU1053083884 | |

| Bloomberg | RC: CBSVERC LX |

| RC-SEK: CBSERCS LX | |

| IC: CBSICAE LX | |

| ID: CBIDLUX LX | |

| The Swedish pension agency: | 976506 |

| LEI: | 529900CM3ES7TC9YOL54 |