Europe’s foremost

quality companies.

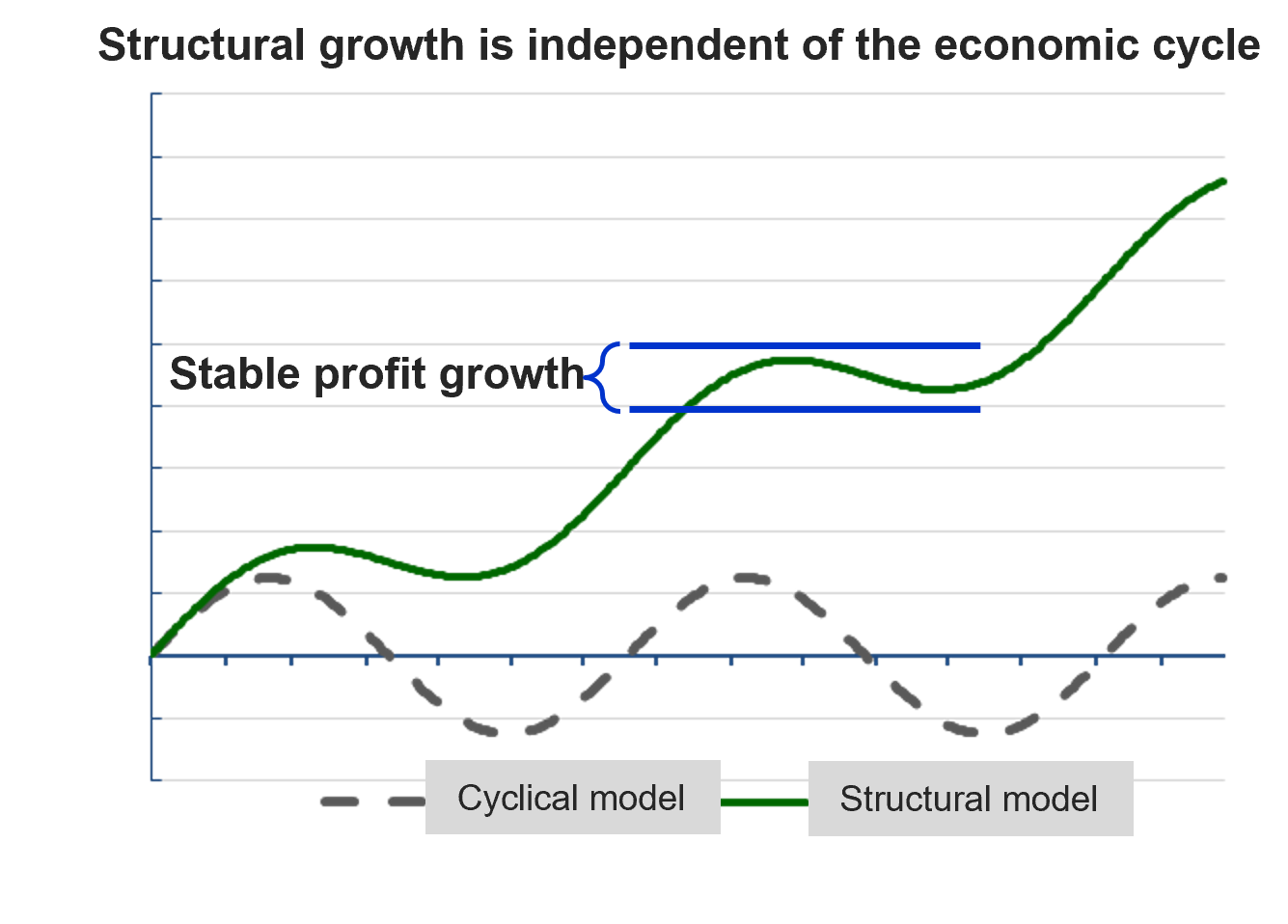

CB European Quality Fund invests in large quality companies within mature industries. These companies should have a proven business model and be protected by high barriers to entry, with strong management that has historically delivered value. Our companies are market leaders with strong products and solid balance sheets, experiencing stable and structural profit growth regardless of the economic cycle.

We are convinced that companies benefiting from structural growth driven by strong trends create more value than cyclical growth and are significantly less dependent on the economic cycle. We have identified several interesting structural growth areas in which we invest.

We have been managing the Europe Fund since 1995, making us one of the most experienced players in the market.

Strategy and Investment Objectives

CB European Quality Fund is an actively managed equity fund that invests in Europe’s leading quality companies. We invest in large companies with a proven business model and high barriers to entry, led by strong management that has historically delivered value.

The fund’s investment universe consists of stocks listed in countries included in the MSCI Europe Net Index. The companies we invest in must have a market capitalization of at least one billion euros.

The focus is on growth companies that are market leaders with strong products and solid balance sheets. Companies should have stable and structural profit growth regardless of the economic cycle. Structural growth is driven by strong trends and creates more value than cyclical growth while being less dependent on the economic cycle.

Our investment decisions are long-term, taking into account an ethical and sustainable framework, as well as the UN Principles for Responsible Investment (UN PRI). We prefer to hold companies for the long term and grow with them.

We are willing to deviate from the index and maintain a concentrated portfolio typically consisting of 25-35 companies in which we have great confidence. Our goal is to outperform our benchmark, the MSCI Europe Net index, over a rolling 12-month period with lower risk than the index. This provides good conditions for high and competitive risk-adjusted returns.

How we work

Our passion for the environment and ethical investments permeates every decision we make. We have operated under an ethical framework for over 25 years and have been involved in environmental investments for over 15 years. This has established us as pioneers in environmental and ethical investing. We invest long-term in high-quality growth companies with sustainable business models and stable profit growth.

Active

We are independent, chart our own course, and always make our own active investment decisions that are independent of the index.

Ethical

We invest in quality companies, according to ethical guidelines and frameworks for sustainable investments from UN PRI and SWESIF.

Long-term

We invest long-term in companies with future potential. If the companies we’ve invested in delivers according to plan, then they stay in our portfolio.

Examples of investment areas

Energy Efficiency

Energy efficiency has an underlying structural growth as large parts of the world transition to greener and more efficient energy utilization to reduce their carbon footprint.

Energy efficiency can, for example, be achieved through improved insulation of buildings or by choosing more energy-efficient installations and appliances, including lighting and ventilation.

Digitalization

Digitalization and software companies are a theme with clear structural growth. With the support of increased digitalization through software, it is possible to streamline all sectors. This leads to higher productivity and better resource utilization.

It creates new opportunities to streamline and optimize the amount of building materials, plan resource-efficient shipments, schedule maintenance, and increase energy optimization to reduce emissions and cut costs.

Health care

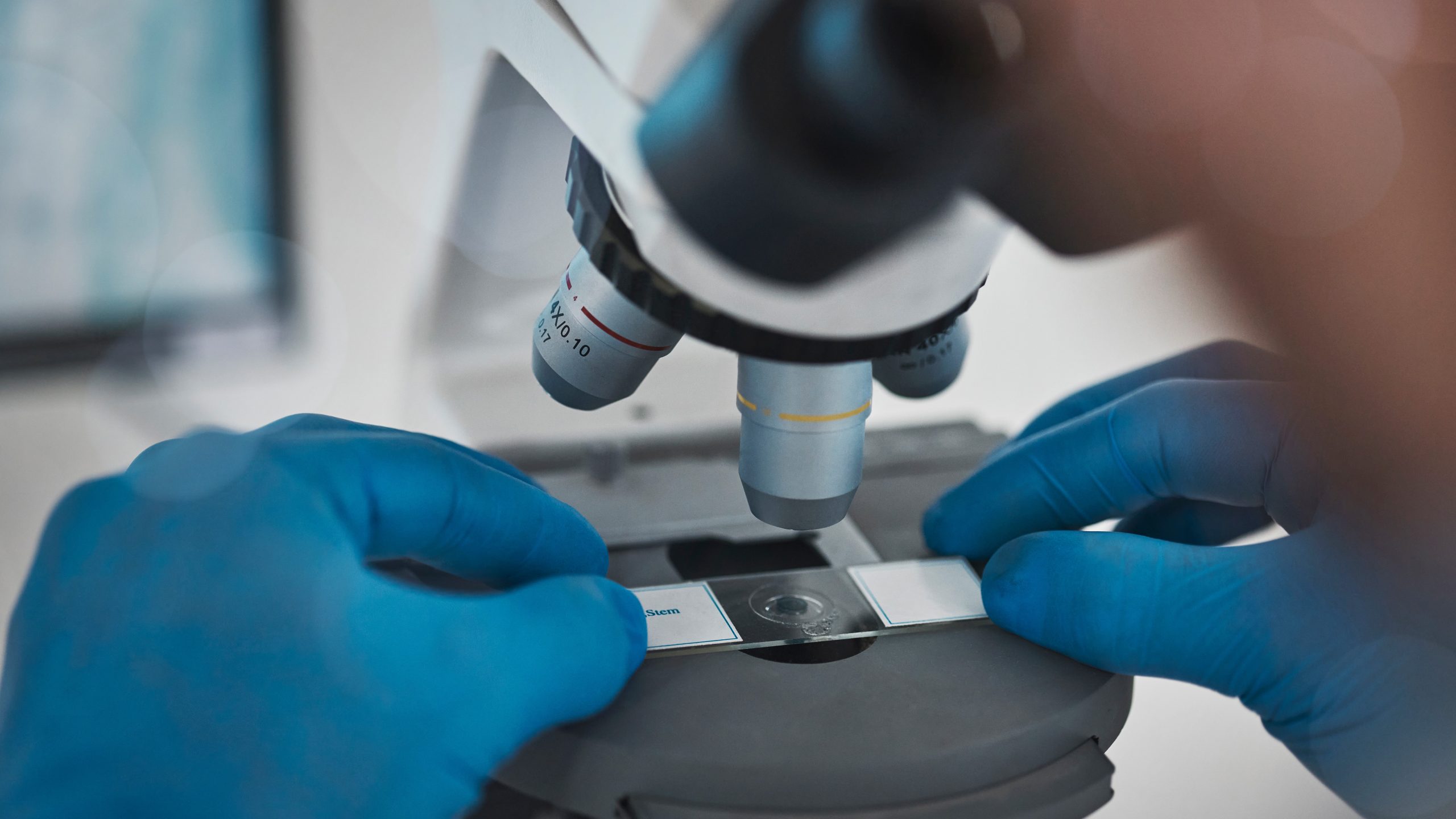

The healthcare sector is growing with the help of structural trends. A generally rising standard of living worldwide combined with an increasingly aging population is creating an increased need for healthcare.

In the wake of a rising standard of living, we get more so-called welfare diseases such as obesity, high blood pressure, and diabetes. Several countries in emerging markets, especially populous countries like China and India, are investing in better healthcare.

Examples of investment areas

Energy Efficiency

Energy efficiency has an underlying structural growth as large parts of the world transition to greener and more efficient energy utilization to reduce their carbon footprint.

Energy efficiency can, for example, be achieved through improved insulation of buildings or by choosing more energy-efficient installations and appliances, including lighting and ventilation.

Digitalization

Digitalization and software companies are a theme with clear structural growth. With the support of increased digitalization through software, it is possible to streamline all industrial sectors. This leads to higher productivity and better resource utilization.

It creates new opportunities to streamline and optimize the amount of building materials, plan resource-efficient shipments, schedule maintenance, and increase energy optimization to reduce emissions and cut costs.

Health care

The healthcare sector is growing with the help of structural trends. A generally rising standard of living worldwide combined with an increasingly aging population is creating an increased need for healthcare.

In the wake of a rising standard of living, we get more so-called welfare diseases such as obesity, high blood pressure, and diabetes. Several countries in emerging markets, especially populous countries like China and India, are investing in better healthcare.

Environmental & Ethical Focus

The funds investments are guided by an ethical and sustainable framework. It is important for us to deliver competitive returns within the framework of environmental, social responsibility, and sustainability. We believe that ethics and sustainability are of utmost importance for a company’s ability to create and maintain stable long-term returns.

Our investment strategy targets high-quality growth companies with sustainable business models and stable profit growth. Both of our funds have received the second-highest ESG rating from MSCI as well as the highest respectively second-highest ratings from Morningstar.

We signed the United Nations Principles for Sustainable Investment in February 2011.

CB European Quality Fund are working towards all of the UN’s 17 Sustainable Development Goals.

We are members of SWESIF, Sweden’s forum for sustainable investments.

Let the experts do the work

We are a dedicated team with more than 10 years of experience in jointly managing the CB Save Earth Fund and CB European Quality Fund. We are a small management team with short decision-making processes, and all decisions are made collectively.

CB Fonder is a family- and partner-owned securities company with over two decades of experience in ethical investments and over 15 years of experience in environmental investments. The fund managers are partners in the company and invested in the funds – we have full incentives to do a good job and are in the same boat as you as investor.

Carl Bernadotte

Majority Owner & Portfolio Manager

Marcus Grimfors

Partner & Portfolio Manager

Alexander Jansson

CEO, Partner & Portfolio Manager

Fund facts

Fund name

CB European Quality Fund

Inception

Strategy: 15 November 1995, Fund: 2 June 2000

Fund type

Equity Fund

Strategy

Long European equities listed in countries in MSCI Europe Index

Holdings

Normally 25-35 stocks

Investment restrictions

Single positions – max 10% of AUM Sum positions > 5% AUM – max 40% of AUM

Target

Outperform MSCI Europe Net – roling 12 months. Lower standar deviation than MSCI Europe Net

Fund company

Luxcellence Management Company S.A., Luxembourg

Depositary

CACEIS Bank, Luxembourg

Domicile

Luxembourg

Fund currency

EUR

Trading

Daily

UCITS-classification

Yes

Share classes

A

D*

I

*Share class D pays a dividend to its shareholders amounting to 3% of NAV twice a year.

Fees

| Share class | A/D | I |

| Management fee: | 1.5% | 0.5% |

| Performance fee: | No | 20% of return > MSCI Europe |

| Subscription fee: | No | No |

| Redemtion fee: | No/1% | No |

| High-water mark: | N/A | Yes, collective eternal and relative |

Fund codes

| ISIN | A: LU0112589485 |

| I: LU0806934948 | |

| D: LU1179404386 | |

| Bloomberg | A: EUREUEA LX |

| I: EUREQIC LX | |

| D: CEQEEFD LX | |

| LEI: | 549300G6TK5TFMDMOC83 |