Europe’s leading quality companies and the world’s best environmental companies.

We are a small and an experienced team, who makes collective investment decisions. Through partnership and our own investments in the funds, our success is directly connected to our investors’ success.

As active investors, we choose the companies in which we believe the most. This approach results in our funds being concentrated and significantly different from the index. Our long-term view means that we invest in companies with structural growth. The turnover in the funds is low, and we typically hold onto the companies for an average of 6-10 years. This strategy reflects our ambition for sustainable and long-term relationships.

We follow strict investment criteria, which serve as our compass in choosing which companies to invest in. Transparency and clarity are central to our decision-making. We don’t invest in weapons, alcohol, tobacco, fossil fuels, or similar areas. Our commitment to ethical investments is part of our core.

Our goal is to deliver high and competitive risk-adjusted returns. We achieve this by building a portfolio with the aim of having lower risk and that performs better during drawdowns compared to our benchmark index.

CB European Quality Fund

Europe’s leading quality companies.

Performance, EUR, 2026-03-05

| Share class | MTD | YTD | Annualized Return* |

| A | -5.4% | +2.3% | +7.0% |

| D** | -5.4% | +2.4% | |

| I | -5.3% | +2.5% |

CB Save Earth Fund

The world’s best environmental companies.

Performance, EUR, 2026-03-05

| Share class | MTD | YTD | Annualized Return* |

| RC | -4.6% | +3.4% | +6.1% |

| IC | -4.6% | +3.4% | |

| ID** | -4.6% | +3.4% |

*Annual return since inception, CB European Quality Fund, November 1995, CB Save Earth Fund, June 2008. **Dividend 6% of NAV per year.

See our Swedish page for performance development in SEK.

Historical returns are not indicative of future performance. The money you invest in funds can both increase and decrease in value, and it is not guaranteed that you will receive back the entire invested capital.

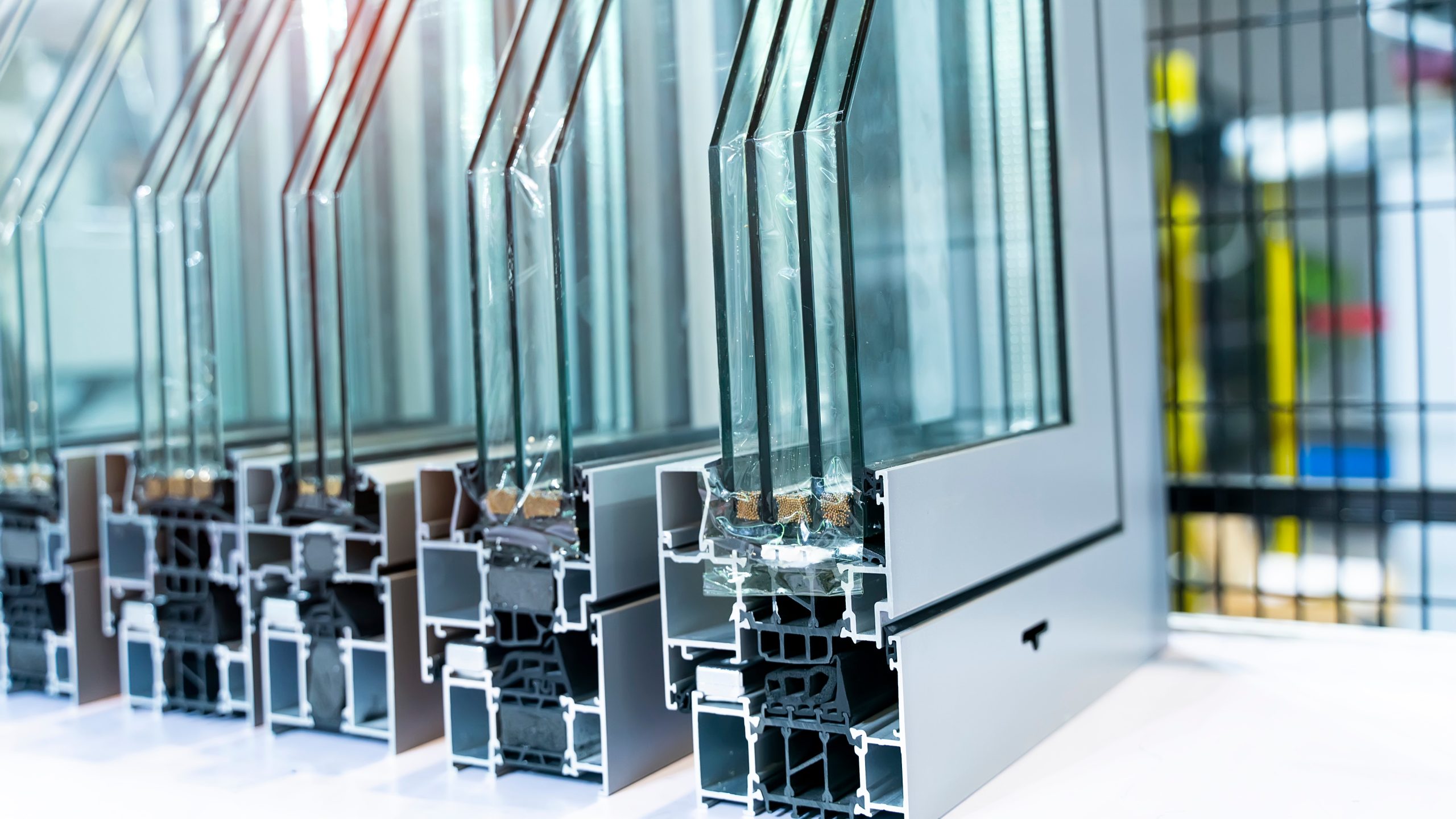

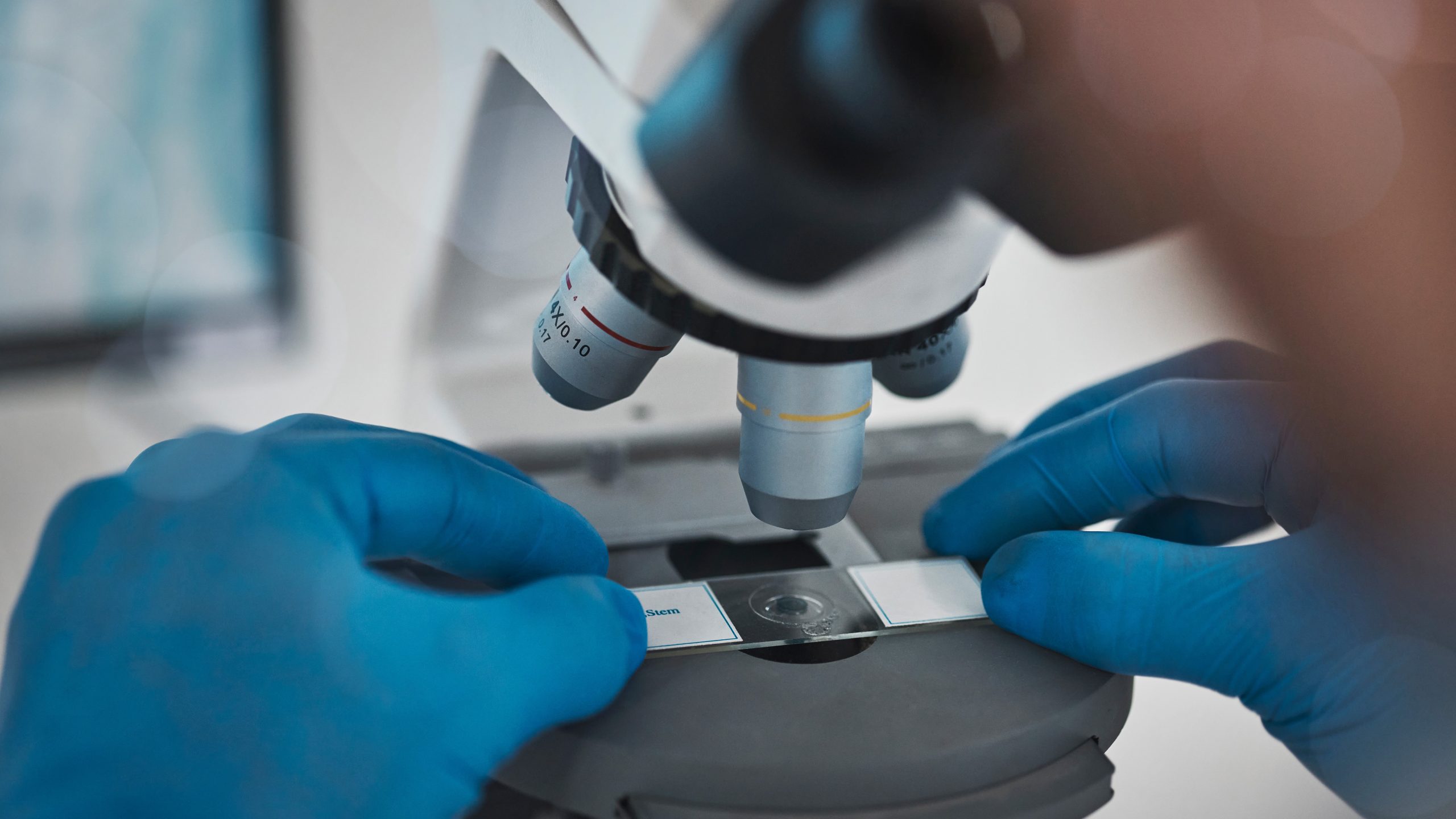

Exemples of investment areas

CB European Quality Fund

CB Save Earth Fund

Let the experts do the work

We are a dedicated team with more than 10 years of experience in jointly managing CB Save Earth Fund and CB European Quality Fund. We are a small management team with short decision-making processes, and all decisions are made collectively.

CB Fonder is a family- and partner-owned securities company with over two decades of experience in ethical investments and over 15 years of experience in environmental investments. The fund managers are partners in the company and invested in the funds – we have full incentives to do a good job and are in the same boat as you as investor.

Carl Bernadotte

Majority Owner & Portfolio Manager

Marcus Grimfors

Partner & Portfolio Manager

Alexander Jansson

CEO, Partner & Portfolio Manager

How we work

Our passion for environmental and ethical investments is part of every decision we make. We have operated under an ethical framework for over 25 years and have been involved in environmental investments for over 15 years. This has established us as pioneers in environmental and ethical investing. We invest long-term in high-quality growth companies with sustainable business models and stable profit growth.

Active

We are independent, chart our own course, and always make our own active investment decisions that are independent of the index.

Ethical

We invest in quality companies, according to ethical guidelines and frameworks for sustainable investments from UN PRI and SWESIF.

Long-term

We invest long-term in companies with future potential. If the companies we’ve invested in deliver according to plan, then they stay in our portfolio.

Environmental & Ethical Focus

We signed the United Nations Principles for Sustainable Investment in February 2011.

Both funds are working towards the UN’s 17 Sustainable Development Goals.

We are members of SWESIF, Sweden’s forum for sustainable investments.