Read the August monthly reports below:

Investment Manager’s Comment

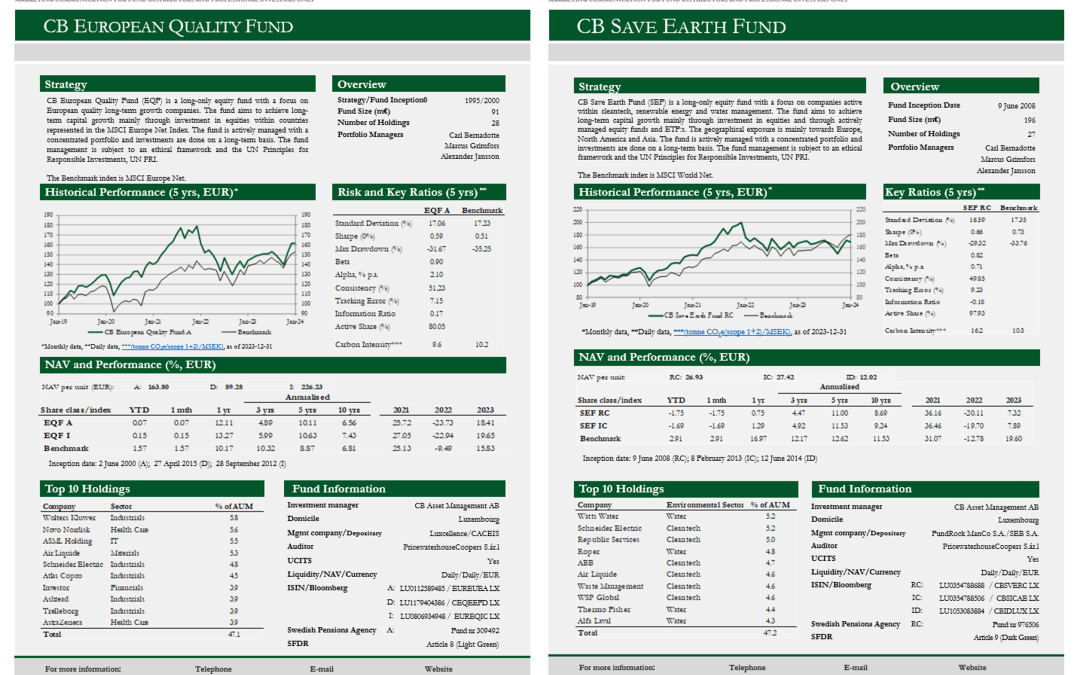

During February and March, we made significant adjustments in the portfolios of CB European Quality Fund (EQF) and CB Save Earth Fund (SEF).

Regarding EQF: Primarily, we implemented a strong overweight in insurance and more value-oriented companies at the expense of growth. This repositioning proved successful in itself, but it would have been even more rewarding to apply a substantial overweight in banks.

Regarding SEF: Mainly, we shifted towards a strong overweight in Europe at the expense of the U.S., and partly a relative overweight in Value at the expense of Growth. This was a correct analysis in certain respects. Among other things, we partly avoided the negative effects of dollar weakness in the first half of the year.

Our analysis was that, due to the Trump administration’s aggressive “America First” policy, European leaders would consolidate and commit to a strong reindustrialization push in order to maintain competitiveness, while simultaneously expanding the defense industry. Instead, the current scenario is as follows:

• The EU pays a tariff of 15% on the majority of goods exported to the U.S., with even higher tariffs on certain items. However, no finalized agreement is yet in place, and the legal basis for the arrangement is being challenged in both the EU and the U.S.

• The EU has increased its budget, which entails a shift of greater power to Brussels. In our view, this is negative for Europe’s long-term growth prospects.

• Europe bears the main share of the costs of Ukraine’s defense against Russia, as Europe pays the U.S. for delivering defense equipment. In terms of financial aid as well, Europe’s contribution exceeds that of the U.S.

• The heavy costs for defending Ukraine, combined with higher spending commitments under NATO, require cutbacks in other areas. With weak economic growth in Europe, the available resources are highly limited, making redistribution of funds necessary.

• A ceasefire in Ukraine in the near term no longer seems likely, and even after a potential ceasefire or peace agreement, major military spending will continue. We therefore foresee a prolonged period with reduced scope for other public investments.

• The U.S. economy, by contrast, is likely to continue on a clearly positive trajectory (earnings growth of +10% in the U.S. compared to +1% in Europe in the most recent quarter).

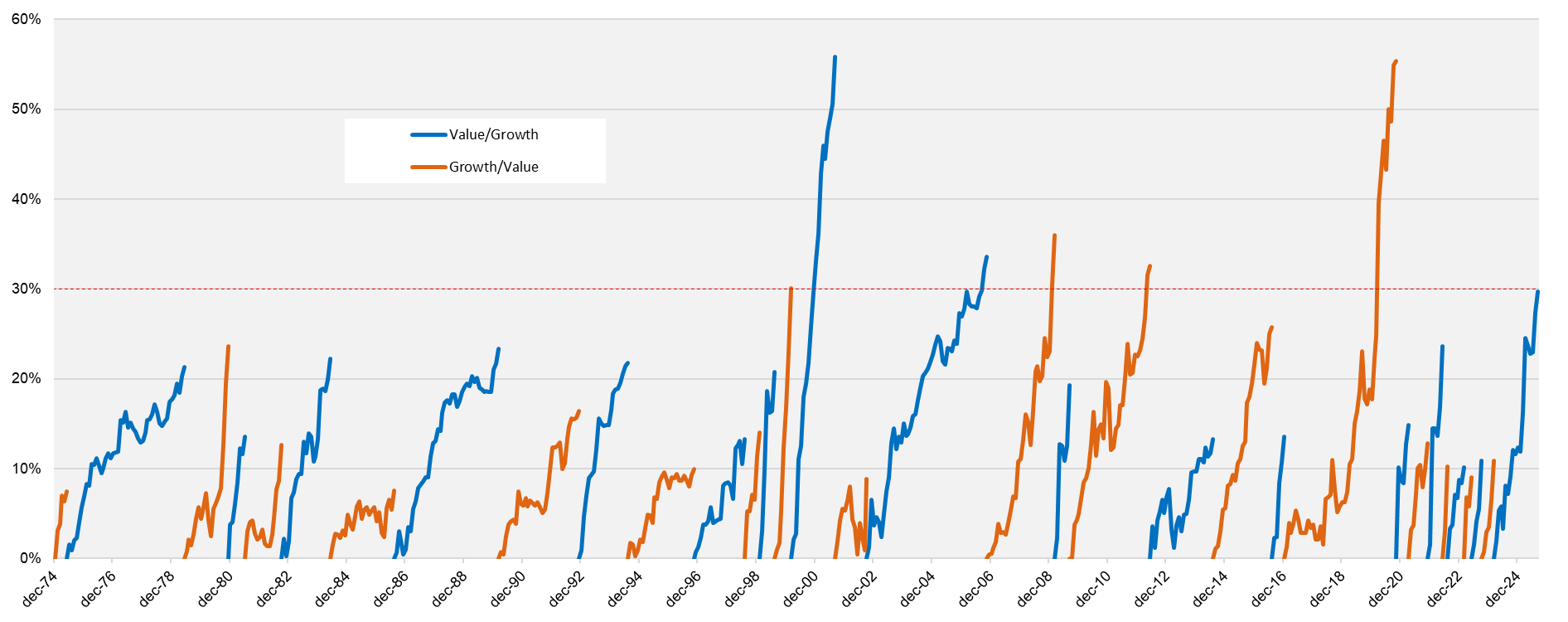

The above points do not mean that we are outright negative on European equities, but we do expect a rotation from “Value” to “Growth” in Europe – i.e., an increased focus on companies whose market positions make them only marginally dependent on a strong economic cycle.

The chart below shows periods when MSCI Europe Value has outperformed MSCI Europe Growth (blue lines), and when MSCI Europe Growth has outperformed MSCI Europe Value (orange lines). As of the end of August this year, MSCI Europe Value had outperformed MSCI Europe Growth by 30%, marking the third-strongest period of Value outperformance against Growth since 1974. Historically, only one Value trend and one Growth trend have delivered outperformance of more than 30%.

This is the reason why we in September have once again reallocated the portfolios as below.

Periods of outperformance for growth and value stocks,

MSCI Europe Net Growth and Value

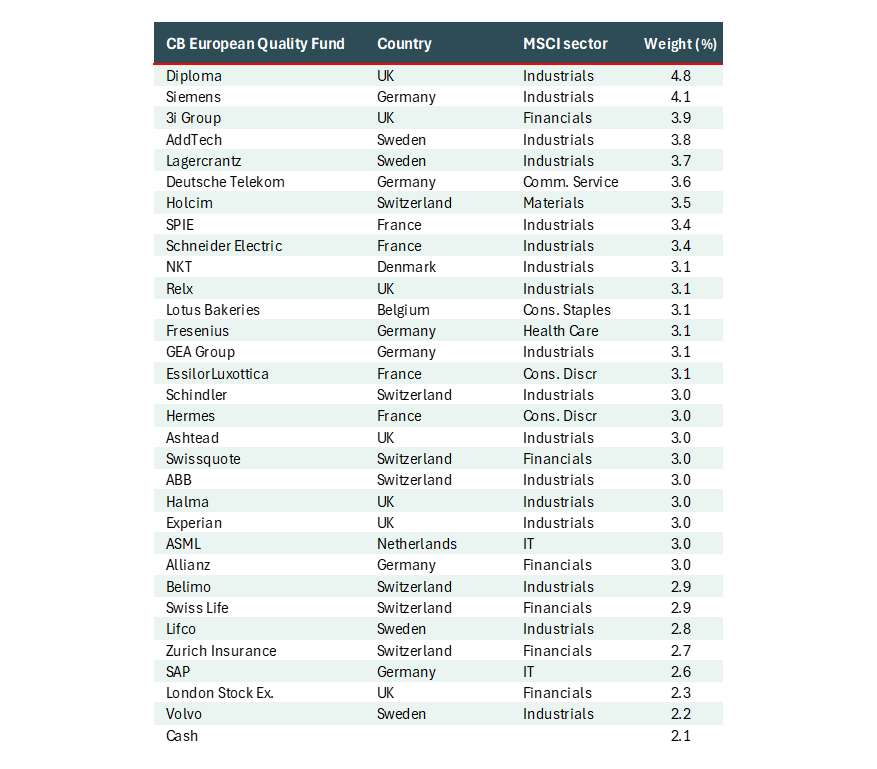

EQF’s portfolio as of 3 September

SEF’s portfolio as of 3 September