During the spring, CB Fonder supervised a master’s thesis in financial mathematics at KTH. The thesis is titled “Risk Management and Sustainability – A Study of Risk and Return in Portfolios With Different Levels of Sustainability” and focuses on the risk of funds divided by ESG ratings.

Our former intern Magnus Borg and his colleague Lucas Ternqvist discovered an intriguing relationship between risk and ESG ratings during this work. They analyzed sustainability/ESG data from MSCI for 3048 global equity funds, using historical data for 3, 5, and 10 years.

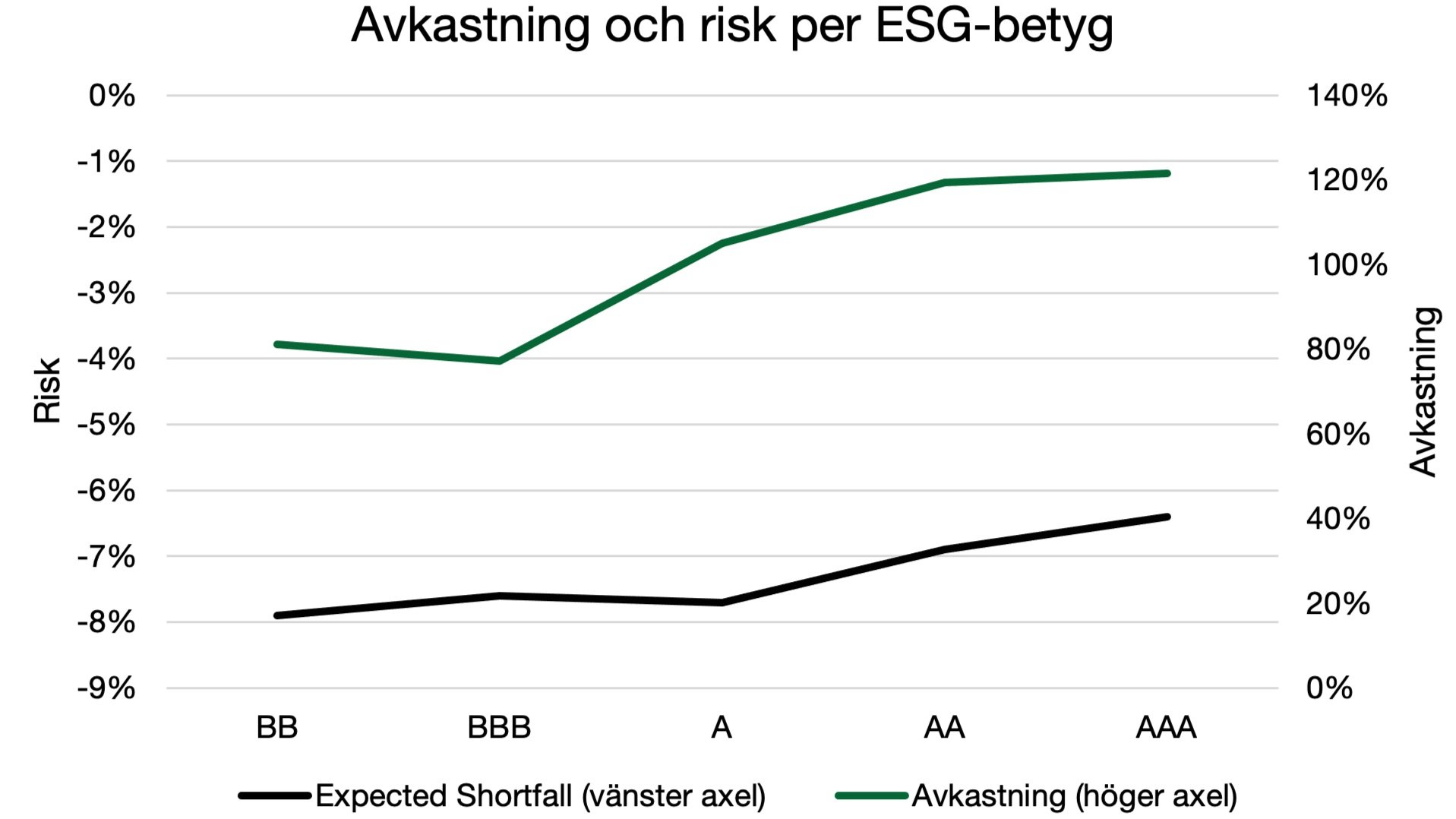

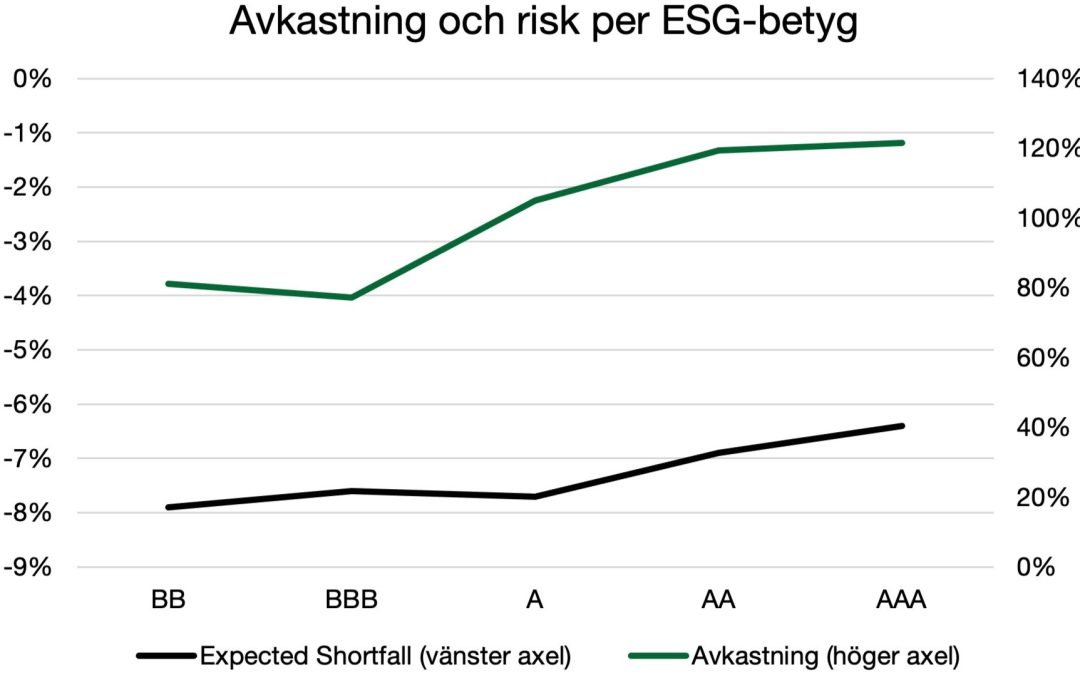

Their conclusion was that funds with a high ESG rating (AAA and AA) exhibited lower risk compared to funds with lower ratings. They also found that returns were positively correlated with ESG ratings: funds with higher ratings, on average, had higher returns.

The graph below depicts returns on the right axis and risk on the left axis. For the risk measure Expected Shortfall, a higher value (less negative) indicates lower risk. Funds with AAA ratings showed both the highest returns and the lowest risk, thus achieving a higher risk-adjusted return than other funds. The analysis is based on historical data for 5 years.

Both our funds, Save Earth Fund and European Quality Fund, have AA ratings.

Read more about us here

Unit prices may increase or decrease in value, and investments always carry a risk of loss. Historical returns and risk levels are never a guarantee of future returns and risk levels. The information in this article is what we, with our knowledge, believe to be correct based on the information available to us for the preparation of this article. No representation or warranty of any kind, express or implied, is made about its completeness, accuracy, reliability, or suitability.

Nothing in this article shall be deemed to constitute financial, legal, tax, or other advice, and no information in this article shall constitute or be deemed to constitute a solicitation or an offer to buy or invest in the financial products mentioned in the article.