Door 9! 🎁

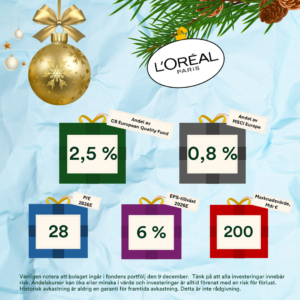

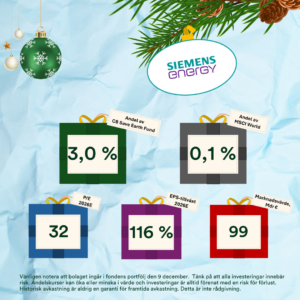

Today we are featuring French L’Oréal in the CB European Quality Fund and German Siemens Energy in the CB Save Earth Fund.

L’Oréal – the world’s largest cosmetics company.

⭐ Founded by a chemist: L’Oréal was founded in 1909 by chemist Eugène Schueller, who was dissatisfied with the hair dyes available on the market at the time.

⭐ 4,000 researchers: L’Oréal invests over 3% of its revenue in R&D and employs more than 4,000 researchers worldwide to drive beauty innovation.

⭐ From budget to luxury: With over 35 international brands, L’Oréal has a portfolio spanning the entire beauty market – from budget to luxury. Examples include Maybelline, Garnier, Lancôme, and YSL Beauty.

🌱 Sustainability focus: L’Oréal works with the UN Sustainable Development Goals and has set SBTi-verified CO₂ reduction targets.

Siemens Energy – one of the world’s largest turbine manufacturers.

⭐ Energy generation: One of Siemens Energy’s largest gas turbines can generate enough electricity to power a city of over one million residents, such as Stockholm.

⭐ H2: Siemens Energy is active in green hydrogen, which is produced using renewable electricity. This is a key component in reducing carbon emissions in the industrial and energy sectors.

⭐ HVDC systems: The company is a key player in high-voltage direct current (HVDC) technology, which is crucial for efficiently transmitting large volumes of renewable energy over long distances.

🌱 Sustainability focus: Siemens Energy works with the UN Sustainable Development Goals, has set SBTi-verified CO₂ reduction targets, and generates revenue aligned with the EU taxonomy.

This message should not be regarded as financial advice, but as marketing material. Please remember that all investments involve risk. Fund unit prices can increase or decrease in value, and investments are always associated with a risk of loss. Historical returns are never a guarantee of future returns. Please note that the companies are part of the respective fund’s portfolio as of December 8th. In theory, the companies may have left the portfolios by the time of the publication of the current door.