Door number 7! 🛷

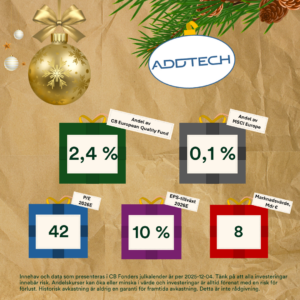

Behind the seventh door we find the Swedish company Addtech AB in the European equity fund CB European Quality Fund, and the American company American States Water Company in CB Save Earth Fund.

Addtech – the technical acquisition machine.

⭐ Strategy: Addtech can best be described as the industry’s Pokémon. Their “Gotta Catch ’Em All” strategy is to acquire small, specialized tech companies — and they do it constantly.

⭐ Decentralization: The business model is built on decentralization. Subsidiaries operate independently, with full responsibility for their own results, driven by entrepreneurial leaders.

⭐ Technical “quad-force”: Wherever an industrial challenge arises, one of Addtech’s 150 subsidiaries can probably solve it — the group today covers everything from power grids to robotic arms.

🌱 Addtech works actively with the UN Sustainable Development Goals, has SBTi-verified CO₂ reduction targets, and generates EU-taxonomy-aligned revenues.

American States Water – the steady drop of dividends

⭐ Delivers water through every market cycle: The company provides essential, regulated services (water and electricity), ensuring stable demand regardless of economic conditions.

⭐ Dividend King: The company has increased its dividend for over 70 (!) consecutive years — the longest dividend-growth streak of any company in the United States.

⭐ Water infrastructure: Operates water and wastewater systems on 11 U.S. military bases through long, stable government contracts.

🌱 American States Water works toward the UN Sustainable Development Goals, especially Goal 6: Clean Water and Sanitation for All.

Please remember that all investments carry risk. Unit prices may increase or decrease in value, and all investing involves the risk of loss. Past performance is never a guarantee of future results. This is not investment advice.

Please note that the CB Funds Christmas calendar presents the fund’s holdings as of December 4, regardless of future developments. This means that, in theory, a company may have left the portfolio by the time its door appears.