The day before Christmas Eve! 🎄

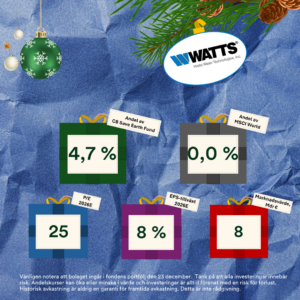

Behind door number 23, we find London Stock Exchange Group in the CB European Quality Fund, Watts Water in the CB Save Earth Fund, as well as the shared holding ABB.

London Stock Exchange Group – a global market infrastructure and data company.

⭐ Global marketplace: One of the world’s largest stock exchanges, with more than 1,900 listed companies from 60 countries and a total market capitalisation exceeding USD 4 trillion.

⭐ Data-driven business: The majority of revenues come from real-time data and analytics through Refinitiv, making LSEG a mission-critical technology provider to the global financial system.

🌱 LSEG has SBTi-validated climate targets and EU Taxonomy–aligned revenues.

Watts Water – a U.S. leader in water standards and building codes.

⭐ Regulatory-driven demand: The company supplies valves, regulators and backflow prevention products that are required to ensure water installations comply with regulations.

⭐ Stability: Renovation-driven demand combined with products that are often legally mandated results in low sensitivity to economic cycles.

🌱 The company has a particular focus on UN Sustainable Development Goal 6: Clean Water and Sanitation for all.

ABB – a Swedish-Swiss global industrial leader in electrification and automation.

⭐ Critical technology: ABB supplies switchgear, power converters and charging infrastructure that enable the electrification of industry, railways and transportation.

⭐ Efficiency gains: Through variable speed drives and motors, industrial processes are optimised, often reducing energy consumption by 20–50%.

🌱 ABB works in alignment with the UN Sustainable Development Goals and has EU Taxonomy–aligned revenues.

Disclaimer:

This communication should not be regarded as financial advice, but as marketing material. All investments involve risk. Fund unit prices may rise or fall, and there is always a risk of loss. Past performance is not a guarantee of future results. Please note that the companies were included in the respective fund portfolios as of 23 December. The holdings may, in theory, have changed at the time of publication of this specific door.