Invest in a

better future

CB Fonder provide you with the opportunity to diversify your investments as our funds contain a concentrated portfolio of various companies and themes, which means that vi deviate much from index and peers.

The objective of the funds we manage is to offer competitive risk-adjusted returns with lower risk and better resilience in downturns compared to the benchmark index. We invest based on an ethical and sustainable framework, which means that no more than five percent of a company’s revenue may come from alcohol, pornography, gambling, tobacco, weapons, or fossil energy.

Our funds are available on most investment platforms, making it easy to integrate them into your savings plan. For example for monthly savings for children and grandchildren and a smarter fund choice for your pension. For institutional investors, we offer an institutional share class with a performance-based fee and a distributing share class.

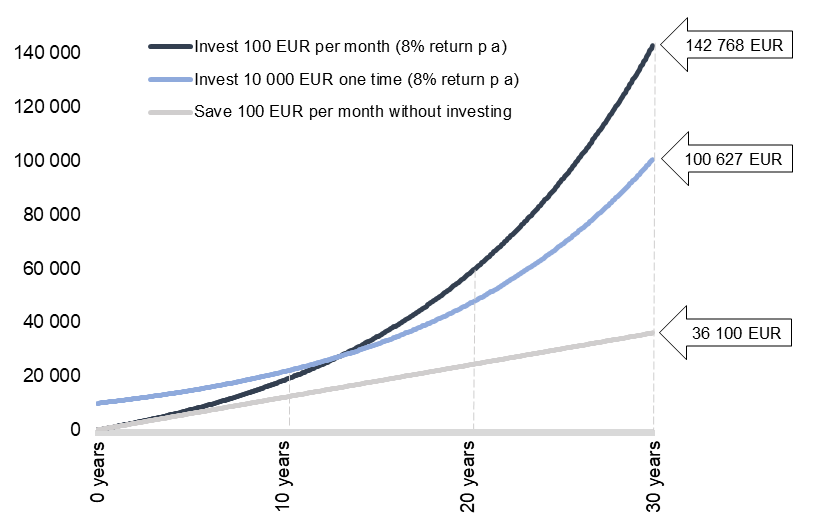

Since inception, CB European Quality Fund has returned approximately +8 % per year for almost 30 years and CB Save Earth Fund approximately +8% per year for over 15 years. This has provided good returns for long-term investors.

To demonstrate the benefits of returns over time, we have created the graph to the right which illustrates three different scenarios. The dark blue curve shows what one would achieve with a +8% annual return over 30 years by investing 100 EUR each month, including at the beginning and end. The light blue line shows what one would achieve with the same return by instead investing 10 000 EUR at one time. The gray line depicts the same monthly savings as the dark blue, but without any return.

The value of funds may increase and decrease, and an investment always carries the risk of loss. Historical performance is not a guarantee of future returns.