Happy fourth Sunday of Advent! 🕯🕯🕯🕯

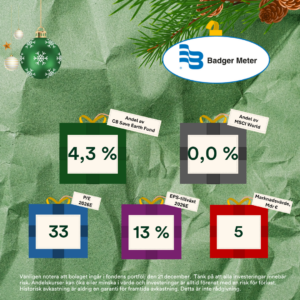

Behind door 21, we find Roche and AAK in the CB European Quality Fund, and Badger Meter in the CB Save Earth Fund.

𝐑𝐨𝐜𝐡𝐞 – A Swiss innovation engine in pharmaceuticals and diagnostics.

⭐ Personalized Healthcare: Roche is a world leader in personalized medicine, where diagnostics and pharmaceuticals converge to deliver superior patient outcomes.

⭐ Broad Exposure: Revenue streams from both pharmaceuticals and diagnostics provide stability across economic cycles and create high barriers to entry.

🌱 The company actively works toward the UN Global Compact Sustainable Development Goals and has established SBTi-verified CO2 reduction targets.

𝐀𝐀𝐊 – A Swedish global leader in plant-based specialty oils and fats.

⭐ Deep Customer Relationships: AAK is integrated early in its customers’ product development processes, creating strong “moats” and high switching costs.

⭐ Product Versatility: The company is the critical link behind everything from chocolate and bakery products to plant-based alternatives, serving both global brands and private labels.

🌱 The company actively works toward the UN Global Compact Sustainable Development Goals and has established SBTi-verified CO2 reduction targets.

𝐁𝐚𝐝𝐠𝐞𝐫 𝐌𝐞𝐭𝐞𝐫 – An American niche leader in smart water metering.

⭐ Digital Water Control: The company provides intelligent meters and software that reduce water leakage and lower operational costs.

⭐ Regulatory Tailwinds: Aging water infrastructure and increasing efficiency requirements are driving global demand. 🌱 The company actively works toward the UN Global Compact Sustainable Development Goals and generates revenue aligned with the EU Taxonomy.

This message should not be considered financial advice, but marketing material. Please remember that all investments involve risk. Share prices may increase or decrease in value, and investing is always associated with the risk of loss. Past performance is never a guarantee of future returns. Please note that these companies are part of their respective fund portfolios as of December 21. In theory, companies may have left the portfolios by the time this post is published.