Door 19!❄️

Behind door 19, we find Diploma in the CB European Quality Fund and WSP in the CB Save Earth Fund, as well as the shared holding Schneider Electric.

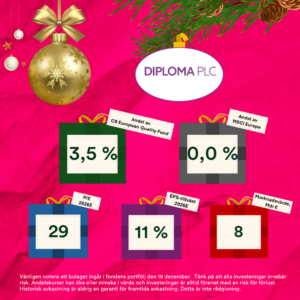

Diploma – a high-yielding British serial acquirer.

⭐ M&A: The company grows both through increased sales and strategic acquisitions that expand its product portfolio and geographic presence.

⭐ Organic engine: Diploma has delivered approximately 7% average organic revenue growth over the past ten years.

🌱 The company has set both short- and long-term SBTi targets.

WSP Global – a world-leading advisor in infrastructure and the environment.

⭐ Clean water: WSP Global designs cutting-edge solutions for advanced water treatment, with expertise in eliminating pollutants such as PFAS.

⭐ Water planning: The company’s consultants help governments, industries, and the public sector optimize water use and meet environmental requirements—from local planning to major national projects.

🌱 The company works with the UN Sustainable Development Goals and has set SBTi targets.

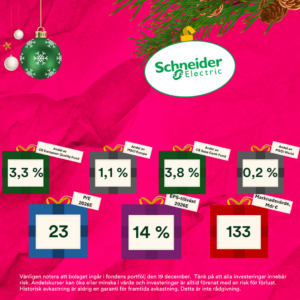

Schneider Electric – a French global leader in industrial technology and energy efficiency.

⭐ Electrification and automation: Schneider provides solutions for smart industries, focusing on digitalization and resilient infrastructure.

⭐ Energy efficiency: The company drives the development of energy-efficient systems and supports customers’ transition to net-zero emissions and reduced carbon footprints.

🌱 The company has set SBTi targets and has revenue aligned with the EU taxonomy.

This message should not be considered financial advice, but marketing material. Please remember that all investments carry risk. Fund unit prices may rise or fall, and investments are always associated with the risk of loss. Past performance is never a guarantee of future results. Please note that the companies are included in their respective fund portfolios as of December 19. In theory, the companies may have left the portfolios at the time this door was published.